In the past two months, although the hot events of memes and head projects’ airdrops have continued, the market has been in a rather gloomy and mysterious atmosphere – the sound of bears seems to be vaguely audible, and the footsteps of bulls are lingering, and the market collapse and restart seem to be only moments away.

This article aims to explore and sort out some of the fermenting events hidden in the market in the past two months, while looking forward to the positive factors that may be overlooked next, and to look forward to the main plot that may be the focus of the next six months.

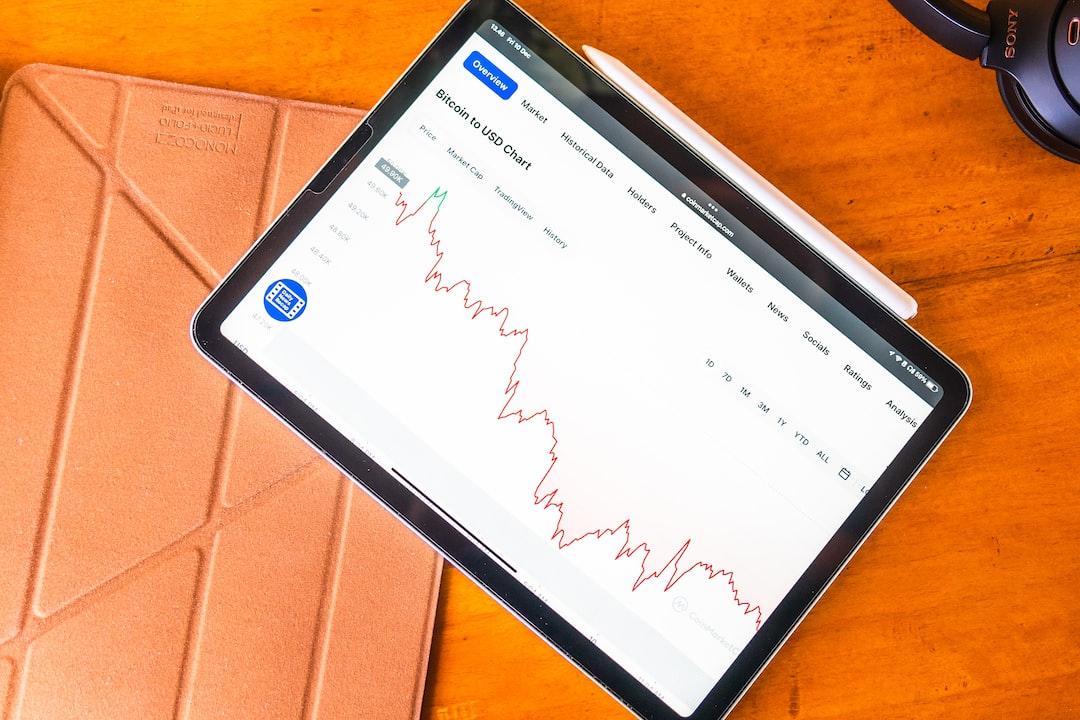

01 The inflow of BTC spot ETF has turned positive from negative

The market always likes to overestimate the short-term effects of new things and underestimate their long-term influence. For the Bitcoin spot ETF, which has been launched for nearly half a year, there has been a signal worth noting recently:

According to SoSoValue data, the Bitcoin spot ETF has shown a new wave of capital inflows since mid-May, lasting for nearly a month. On June 4, it reached a historical high of 8.86 billion US dollars (second only to 10.5 billion US dollars on March 12).

Although there has been a continuous decline this week, the overall situation has clearly reversed compared to April and May. At the time of writing (June 21), the net asset value of the Bitcoin spot ETF was 56.24 billion US dollars, and the ETF net asset ratio (the proportion of the market value to the total market value of Bitcoin) reached 4.39%. The total cumulative net inflow was 14.67 billion US dollars.

02 The giant ship of cryptocurrency regulation turns and the Ethereum spot ETF suddenly accelerates

The background of the 2024 general election has recently shown that both the regulatory and capital levels have significantly improved, brewing a new round of bullish catalysts.

First, on May 22, the “21st Century Financial Innovation and Technology Act” (FIT21 Act) was passed in the House of Representatives by a vote of 279 to 136. Then, on May 24, the U.S. Securities and Exchange Commission (SEC) officially approved 8 Ethereum spot ETFs’ 19b-4 forms.

This means that the US regulatory position has softened from being tough, especially the expected approval of the Ethereum ETF has been significantly advanced. It seems that the change in the attitude of the US regulatory agencies and the approval speed far exceeded expectations, but in retrospect, it seems that it is not without a trace: at least as early as around $3000, whales such as Justin Sun started to accumulate ETH chips and firmly bet on the ETH/BTC exchange rate, which seems to indicate that individuals or institutions with keen foresight have made early layouts.

Directly, the performance of ETH in the secondary market has also swept away the previous decline and has begun to strengthen step by step. The most obvious change is the ETH/BTC exchange rate. Since October last year, the ETH has continued to decline compared to BTC, and the ETH/BTC exchange rate has even fallen from above 0.064 to below 0.045.

Since mid-May, the ETH/BTC exchange rate has begun to show a downward trend, breaking through the 0.05 and 0.055 marks in the past month, and reaching a recent high of 0.058, showing overall strength.

03 Traditional Web2 players accelerate their layout in Web3

On June 6, Robinhood officially announced that it would acquire the cryptocurrency trading platform Bitstamp for $200 million to expand its business outside the United States. The two parties have reached an acquisition agreement, but it needs to be approved by regulatory agencies – compared to the acquisition price of $400 million by the South Korean company NXC’s subsidiary NXMH in 2018, it is considered a big bargain.

It is well known that Robinhood is one of the most commonly used stock and cryptocurrency CEX by American users, with 11 million monthly active users. Its popularity in the field of cryptocurrency trading is even higher than Coinbase: Robinhood’s trading-based revenue in the first quarter of this year increased by 59% year-on-year, reaching $329 million, of which cryptocurrency revenue was $126 million, an increase of 232%, showing very strong performance.

Established in 2011, Bitstamp, as the longest-running global cryptocurrency CEX, is also considered one of the more compliant CEX. Its business covers Luxembourg, the UK, Slovenia, Singapore, and the United States. It also has valid licenses and registrations in more than 50 countries/ regions around the world, providing assistance to Robinhood in its expansion of cryptocurrency business in other regions.

This is almost a perfect complementary relationship – Robinhood’s current market mainly focuses on the United States, while its competitors Kraken and eToro have stronger businesses in Europe. Therefore, although Bitstamp’s 4 million users are not many, most of them are in Europe, making it a huge leap for Robinhood’s expansion into Europe.

It is worth noting that just a month ago, Robinhood received a Wells notice from the U.S. Securities and Exchange Commission (SEC) staff, which involved themes such as the listing, custody, and platform operation of RHC’s cryptocurrency assets. Therefore, this acquisition will expand Robinhood’s global layout map, offsetting the strong regulatory impact of the U.S. SEC, and ensuring that it never leaves the table.

In addition, Fortune magazine predicts that this transaction, besides adding about 4 million new cryptocurrency customers to Robinhood, will also enable Robinhood to provide a wider range of cryptocurrency products to more institutional customers: from the 15 tokens currently available in the U.S. market and the 30+ tokens available in Europe, expanding to over 85 tokens included in Bitstamp. Also, Bitstamp’s diversified services (such as pledging, stablecoins, trading, custody, and major brokerage businesses) will help Robinhood attract more institutional customers and may accelerate its expansion in the European market.

04 The macro environment has sounded the horn of easing

Although the U.S. CPI, PPI, non-agricultural, and other data have repeatedly exceeded expectations in the past six months, Federal Reserve officials have begun to “harden their stance,” causing the market to continuously adjust its interest rate reduction expectations. However, at least for the time being, inflation has basically come to an end, and people remain cautiously optimistic about the Fed’s interest rate reduction bets for the second half of the year.

John Williams, a permanent voter of the FOMC, “three-handed” of the Federal Reserve, and president of the New York Fed, emphasized this week that any decision on the timing or degree of interest rate cuts this year will depend on the economic data to be released soon. At the same time, Fed officials have lowered their expectations for interest rate cuts this year, with the median official predicting only one interest rate cut.

However, the Bank of Canada and the European Central Bank, which are considered to be the vanguard of the Federal Reserve, have taken the lead in turning the corner and running ahead of interest rate cuts: on June 5, the Bank of Canada lowered the interest rate from 5% to 4.75% for the first time in 4 years; on June 6, the European Central Bank lowered the interest rate from 4% to 3.75% for the first time in 5 years.

In any case, the global wave of interest rate cuts has further accelerated, and favorable macro-level factors have indeed been accumulating.

05 Large payment/financial institutions return

In addition, not long ago, BN allowed Mastercard users to buy cryptocurrency on BN, and the Visa card of the BN brand has also been restored for use on the trading platform. BN stated that the withdrawal services using Mastercard will be resumed later.

As early as March, MetaMask also reached a cooperation with Mastercard to conduct the first test of a blockchain payment card. Marketing materials show that MetaMask/Mastercard payment cards issued by Baanx will be “the first truly decentralized Web3 payment solution,” allowing users to use cryptocurrency for daily consumption wherever bank cards are accepted.

This undoubtedly solves the problem of the cognitive and entry barriers of incremental users to a great extent, and moves towards entry and exit without feeling (fiat currency, stablecoin instant exchange), abstracting the user experience for easy use (account abstraction, close to the Web2 payment experience), etc., especially as it bridges the link between cryptocurrency and offline consumption scenarios, which is conducive to anchoring cryptocurrency assets to a wider range of asset pools.

06 Summary

Overall, in this market environment of alternating cold and warm, there are still quite a few positive factors fermenting slowly, and as long as you observe carefully, you can still see confidence.

Although the sound of bears seems to be vaguely audible, and the footsteps of bulls are lingering, in this context, keeping cautiously optimistic, observing and actively participating at all times may be the only thing to do in the current market atmosphere.